Top 5 Luxury Hotel Brands Leading Europe’s Expansion (2019–2024)

Luxury Hotel Developments Leading Europe Hotels Expansion

It is a common question among hotel developers which hospitality sector in Europe offers the highest ROI. With an increasing number of travellers due to cheaper tickets and more accessible transportation, people are travelling more than ever. This phenomenon has significantly increased the demand for accommodation. For several decades, demand was mostly focused on affordable accommodation options. It's no wonder that new tech companies like Airbnb achieved such huge success, even prompting municipalities to intervene to regulate them.

In recent years, however, there's been a notable shift toward quality over quantity. With greater choices and widespread use of booking websites and social media, lifestyle hotels have taken the lead. The emergence of design hotels and the rising importance of storytelling have transformed the industry. Travellers now want to be part of a narrative and seek unique experiences. This shift has substantially increased demand for lifestyle and new-luxury hotels, making this sector one of the most profitable of all.

Bigger hotel chains have noticed this trend and are rapidly expanding their new-luxury and ultra-luxury segments by acquiring existing hotels, redefining their brands, and developing concepts suited to iconic boutique buildings. In this article, we examine the most successful hotel chains and explore what strategies they've employed over the last five years to maintain their competitive edge.

1. Marriott International

Marriott has capitalized on conversions of historic properties – the lobby of H15 Palace Hotel in Kraków (Luxury Collection) is one example of its adaptive-reuse projects in Europe.

Marriott has capitalized on conversions of historic properties – the lobby of H15 Palace Hotel in Kraków (Luxury Collection) is one example of its adaptive-reuse projects in Europe.

Expansion Strategy: Marriott, the world’s largest hotel company, has pursued an aggressive growth plan in Europe. It announced plans to add ~100 hotels (over 12,000 rooms) in Europe by 2026, largely through conversions and the adaptive reuse of existing buildings. These conversions – often bringing independent luxury hotels into Marriott’s system – allow owners to retain local character while tapping into Marriott’s powerful engines and Bonvoy loyalty network. Marriott now operates 800+ properties (150,000 rooms) across 47 European countries under 25 brands.

Key Locations & Projects: Marriott’s luxury portfolio (which globally spans 658 hotels across 7 high-end brands has grown in Europe via new openings and reflags. For example, W Hotels entered the Czech Republic with W Prague in 2024, and The Luxury Collection debuted in Germany with the Hotel Königshof in Munich. Marriott is also introducing its luxury brands to new markets – a JW Marriott resort in Crete (opening 2025) marks that brand’s first in Greece. High-profile conversions include turning historic palazzos and grand dames into St. Regis, Edition, or Luxury Collection hotels, such as the new H15 Palace Luxury Collection Hotel Kraków and an upcoming St. Regis in London’s Mayfair (The Westbury redevelopment).

Business Approach: Marriott’s expansion is fueled by an asset-light, affiliate-heavy model – encouraging franchisees and owners to join for competitive fees and access to Marriott’s distribution. The company leverages its size and Starwood acquisition legacy (2016) to offer an unrivaled brand portfolio from classic luxury (Ritz-Carlton, St. Regis) to contemporary lifestyle (W, Edition). It reported a record 61 new luxury hotel deals signed in 2024, bolstering a pipeline of 266 luxury properties worldwide – a portion of which are in Europe. By focusing on fast-growing segments (e.g. residential-branded projects, all-inclusive resorts) and loyalty integration, Marriott has maintained its lead. Notably, over 10% of Marriott’s European pipeline through 2026 is in its luxury brands (Luxury Collection, W, Ritz-Carlton, St. Regis), indicating a deliberate push at the high end.

2. Hilton Worldwide

Resort boom: Hilton is doubling down on leisure destinations like the Numo Ierapetra Beach Resort in Crete (Curio Collection), as Mediterranean travel demand soars.

Expansion Strategy: Hilton has seen record-breaking growth, adding 973 hotels (nearly 100,000 rooms) globally in 2024 alone. In Europe, Hilton’s focus has been on resort and lifestyle expansion to capture the leisure travel surge. It plans to open 10 new resort hotels in European sun destinations (Greece, Ibiza, Sardinia, Malta) by summer 2024. In fact, more than 20 new resorts in Europe/Middle East were signed in 2023 under various Hilton brands. This contributed to Hilton doubling its resort portfolio over five years to 300+ properties worldwide. Simultaneously, Hilton launched new brands (e.g. LXR luxury collection, Canopy lifestyle, Tempo and Motto) and forged partnerships to accelerate growth.

Key Locations & Projects: Hilton’s luxury flags – Waldorf Astoria, Conrad, and LXR – have been extended to Europe’s prime cities and resorts. Upcoming openings include Conrad Hamburg and Conrad Athens (rebranding the historic former Hilton Athens) in 2024/25. Hilton is also growing via “soft” brands that convert independent hotels: Curio Collection and Tapestry Collection have added distinctive European properties (e.g. boutique resorts in Ibiza and Crete). Notably, Numo Ierapetra in Crete and several Ibiza resorts joined Curio Collection. In London, Hilton’s LXR debuted with The Biltmore Mayfair, and Waldorf Astoria is slated to take over the Admiralty Arch in a monumental conversion. These projects illustrate Hilton’s strategy of planting luxury flags in landmark locations.

Business Approach: Hilton has largely pursued organic growth (versus large mergers) by leveraging its development partnerships and adding new brands/affiliations. In 2024 it integrated two niche brands – Graduate Hotels and NoMad – into its system to diversify offerings. A major initiative was an exclusive partnership with Small Luxury Hotels of the World (SLH), adding hundreds of independently owned luxury boutiques to Hilton’s distribution network. This move instantly broadened Hilton’s luxury footprint (now 500+ luxury properties worldwide, rivaling Marriott). Hilton’s success factors include a strong Honors loyalty program and a reputation among owners for driving high occupancy. As CEO Chris Nassetta noted, Hilton’s “family of brands” and powerful commercial engines give it confidence for ~6–7% net unit growth annually. Hilton has sustained rapid European growth by targeting high-demand segments (resorts, lifestyle hotels) and franchising with regional partners (e.g., a development deal for 10 new hotels in Germany).

3. Accor

Ultra-luxury revival: A suite at the upcoming Orient Express La Minerva in Rome (opening 2025) showcases Accor’s push into bespoke luxury experiences, reviving the historic Orient Express brand.

Expansion Strategy: Paris-based Accor has transformed itself over the past five years into a luxury-focused hotel group, aiming to close the gap with Marriott and Hilton. Under CEO Sébastien Bazin, Accor increased its share of luxury rooms from 6% in 2015 to over 10% by 2025. The group now has 380+ luxury hotels globally (vs. Marriott’s 534), including legacy brands Sofitel and Fairmont/Raffles and newer additions. Accor’s strategy emphasizes brand acquisition and creation: it acquired Fairmont, Raffles, and Swissôtel in 2016 (integrating iconic properties like The Savoy in London and Raffles Paris), and is now launching the Orient Express ultra-luxury brand in 2025.

Key Locations & Projects: Accor’s luxury expansion in Europe has been both through new developments and rebranding of landmarks. It scored a coup with Raffles London at The OWO, a conversion of the Old War Office in Whitehall that opened in late 2023 – a high-profile debut for the Raffles brand in London. Likewise, Accor rejuvenated the Fairmont brand: the historic Carton House in Ireland and Carton Cannes (France) joined Fairmont’s portfolio after renovations, and Fairmont has ~30 new hotels in its pipeline. In Italy, Accor will introduce Orient Express La Minerva in Rome, a 17th-century palazzo turned 93-room ultra-luxury hotel overlooking the Pantheon.

The Orient Express venture also extends beyond hotels to luxury trains and even yachts, highlighting Accor’s innovative approach. Additionally, Accor’s Sofitel brand (124 hotels globally) is undergoing a revamp – including major renovations (25% of Sofitels updated) and refreshed French-inspired service standards – to strengthen its position in cities like Paris, Rome, and London. New soft-brand collections (MGallery and the recently launched Emblems Collection) have enabled Accor to sign independent luxury hotels across Europe by offering more flexible affiliation models.

Raffles London

Business Approach: Accor’s expansion is characterized by strategic partnerships and a “house of brands” structure. The company reorganized in 2023 to give each luxury marque (Fairmont, Raffles, Sofitel, etc.) more autonomy – akin to LVMH’s portfolio of luxury maisons. Seasoned hoteliers like Omer Acar were appointed as CEOs of specific brand portfolios (he now helms Raffles & Fairmont) to tailor growth and guest experiences. Accor also isn’t shy about non-traditional growth: for example, it partnered with Orient Express’s owners to bring that storied brand back, and it has a stake in lifestyle operator Ennismore (Delano, Mondrian, etc.) to capture luxury-lifestyle demand. While smaller than its U.S. rivals in total luxury units, Accor leverages its European home advantage – a deep development pipeline in EMEA and iconic properties that anchor its brands. Common to its strategy are themes of heritage and exclusivity (resurrecting legendary names, preserving historic hotel identities) combined with the scale advantages of a global network (distribution, ALL loyalty program). This dual approach has positioned Accor as a key driver of Europe’s luxury hotel growth.

4. IHG Hotels & Resorts

Six Senses Douro Valley - Portugal

Expansion Strategy: IHG (InterContinental Hotels Group) has aggressively expanded its luxury and lifestyle portfolio in Europe via acquisitions and alliances. In the last five years, IHG added multiple top-tier brands to its stable: it acquired Six Senses Hotels & Resorts in 2019, bought a majority stake in Regent Hotels in 2018, and just in 2025 purchased Ruby Hotels, a European “lean luxury” brand. These moves significantly increased IHG’s presence in the high-end segment. IHG has also formed strategic partnerships – notably a 2022 long-term alliance with Spain’s Iberostar Hotels & Resorts that brought up to 70 Iberostar beach resorts (24,300 rooms) into the IHG system. Under this deal, Iberostar’s upscale and luxury coastal properties (e.g. Iberostar Selection Anthelia in Tenerife) now operate as Iberostar Beachfront Resorts with access to IHG’s distribution and One Rewards loyalty. These acquisitions and partnerships have quickly boosted IHG’s footprint in European resort destinations and city centers.

Key Locations & Projects: IHG’s flagship InterContinental brand, while mature in Europe, saw rejuvenation through marquee projects like the InterContinental Rome Ambasciatori Palace (opened 2023) and a full renovation of the InterContinental (now Regent) Carlton Cannes. The Carlton Cannes underwent a two-year, multi-million Euro redevelopment and reopened in 2023 as a Regent – the first new-generation Regent in Europe, signaling IHG’s intent to revive that storied luxury name. Meanwhile, Six Senses – known for wellness-centric ultra-luxury – has expanded under IHG: Six Senses Ibiza opened in 2021 as a tranquil Balearic retreat, and Six Senses Rome launched in 2023, blending contemporary design into a historic palazzo off the Trevi Fountain. IHG also introduced its boutique Kimpton Hotels brand to Europe: properties like Kimpton Vividora Barcelona (2020) and Kimpton St Honoré Paris (2021) have brought its playful luxury to major cities. In total, IHG opened 10+ hotels in Spain alone over five years, including those Kimptons, InterContinental Barcelona, and Six Senses Ibiza. On the lifestyle front, IHG created the Vignette Collection in 2021 to attract independent luxury hotels – one of the first Vignette hotels in Europe will be Prague’s iconic Carlo IV hotel. The recent Ruby Hotels acquisition adds 20 modern, high-design hotels across Germany, Austria, the UK and beyond (and 10 more in development) squarely into IHG’s portfolio. Ruby’s concept of sleek “lean luxury” (stylish, space-efficient rooms with tech-driven service) appeals to the upscale urban market, and IHG plans to scale Ruby from its current European base to 100+ hotels globally in the next decade.

Intercontinental Crete

Business Approach: IHG’s growth approach has been to fill portfolio gaps and scale up quickly through M&A. By adding brands like Six Senses (resorts/wellness), Regent (classic luxury), Kimpton (boutique/lifestyle), and Iberostar (resorts/all-inclusive), IHG can compete across the luxury spectrum without starting from scratch. Many of these deals are asset-light – e.g. Iberostar retains ownership of its properties, using IHG’s brand and distribution. IHG then leverages its enterprise platform to grow the acquired brands (for instance, plans to expand Ruby Hotels beyond Europe, using IHG’s owner contacts and technology backing). Another pillar of IHG’s strategy is revitalizing iconic properties under new brands, as seen with the Carlton Cannes (Regent) and the forthcoming rebranding of the Waldorf Astoria Amsterdam to InterContinental. The company also emphasizes the strength of its IHG One Rewards loyalty program to attract luxury travelers and owners – a motivation behind aligning with Iberostar’s largely leisure customer base. Though smaller than Marriott or Hilton, IHG’s luxury & lifestyle pipeline is growing fast. By the end of 2024, it counted 450+ luxury/upscale hotels in Europe (across brands like InterContinental, Hotel Indigo, etc.) and more in the pipeline. The common thread in IHG’s expansion is strategic bold moves (acquire or partner with established luxury players) coupled with a focus on trending markets (e.g. resort locales, design-conscious urban hotels) to capture new demand.

5. Hyatt Hotels Corporation

Park Hyatt London

Expansion Strategy: Hyatt has emerged as one of the fastest-growing luxury hotel players in Europe despite a smaller base. Since 2017, Hyatt has nearly doubled its global portfolio (90% growth) to 1,350+ hotels, driven largely by its focus on luxury, lifestyle, and resort segments. In EMEA (Europe, Middle East, Africa), Hyatt’s footprint expanded over 55% by room count, reaching 200+ properties (45,000+ rooms) across 40 countries as of late 2024. This was achieved through targeted acquisitions and partnerships: Hyatt’s acquisition of Apple Leisure Group (ALG) in 2021 was a game-changer, adding a portfolio of ~100 luxury and upper-upscale all-inclusive resorts (under brands like Secrets, Dreams, Alua) in the Caribbean and Europe. Many ALG resorts in Spain, Greece, and the Canary Islands became part of Hyatt’s new Inclusive Collection, instantly boosting Hyatt’s presence in European leisure markets. Hyatt also took a minority stake in Standard International in 2024, bringing the trendy The Standard, Ibiza hotel into Hyatt’s fold and paving the way for more Standard hotels under Hyatt’s distribution. Additionally, in late 2023, Hyatt formed a 50/50 joint venture with Grupo Piñero to integrate Bahia Principe – adding five beachfront resorts in Spain (and 16 in the Americas) to Hyatt’s system. These moves reflect Hyatt’s strategy of inorganic growth to quickly scale in Europe.

Key Locations & Projects: Historically underrepresented in Europe, Hyatt introduced several of its luxury brands to new cities recently. Park Hyatt, Hyatt’s flagship luxury brand, opened in London for the first time (Park Hyatt London River Thames, 2023) and has projects underway in Lisbon and Johannesburg. Andaz, Hyatt’s boutique luxury brand, entered Lisbon (opening 2024) and will debut in Prague, adding to existing Andaz hotels in London, Amsterdam, and Munich. In lifestyle, Thompson Hotels – acquired via Two Roads Hospitality – arrived in Europe with Thompson Madrid in 2022, a chic 175-room property near Gran Vía. Hyatt is also moving into new European countries: between 2025 and 2028 it plans to open hotels in 13 new markets such as Iceland, Estonia, Romania, and Hungary, where it currently has none. Many of these will carry Hyatt’s collection or lifestyle brands (e.g. a Unbound Collection hotel in Tallinn, a Hyatt Centric in Reykjavík). On the resort side, Hyatt’s ALG acquisition has yielded expansions like AluaSoul Costa Adeje in Tenerife (rebranded 2023) and Secrets Playa Blanca on Lanzarote. Moreover, Hyatt’s wellness resort brand Miraval is slated for its first international opening (in Saudi Arabia’s Red Sea, 2025), and could extend to Europe in the future as wellness travel grows. As of 2024, Spain stands out as a key growth market for Hyatt – thanks to ALG and Bahia Principe, Hyatt’s Spanish portfolio jumped from a handful to over 20 properties in a short span. This includes hotels across the Balearic and Canary Islands and mainland Spain, positioning Hyatt to tap Europe’s sun-and-sea luxury segment.

AluaSoul Costa Adeje in Tenerife

Business Approach: Hyatt’s approach centers on “intentional growth” – focusing on segments and locations where it can be a leader rather than sheer volume. It long stayed smaller and more upscale-focused than its peers, but in recent years Hyatt recognized the need for scale, hence the bold acquisitions. By folding in established luxury brands (ALG’s AMResorts, Standard, Thompson, Alila, etc.), Hyatt rapidly broadened its offerings while maintaining a high-end image. Hyatt has also been a pioneer in partnering with independent collections: since 2018, World of Hyatt members have been able to earn and redeem at Small Luxury Hotels (SLH) properties through a partnership – a model later emulated by Hilton. In 2023, Hyatt doubled down on this strategy by acquiring the Mr & Mrs Smith travel club platform, which curates boutique luxury hotels, to further boost direct bookings of unique hotels (this came just as Hyatt’s SLH partnership concluded). A hallmark of Hyatt’s expansion is its focus on leisure and lifestyle travel: CEO Mark Hoplamazian noted that their accelerated growth “is a testament to Hyatt’s strength in luxury, lifestyle, and all-inclusive hospitality”. Hyatt tends to enter new markets with luxury brands first (to build cachet) then follow with upscale/select-service. All five of its new markets in Europe plan announced in 2025 are luxury or lifestyle openings. Another strength is customer loyalty – Hyatt’s smaller but very engaged World of Hyatt program and its reputation for exceptional service help it punch above its weight in attracting high-end travelers. By strategically targeting Europe’s most “important markets” for its customers and owners, and offering a differentiated portfolio, Hyatt has achieved remarkable growth momentum in the region.

Comparative Analysis: Common Success Factors

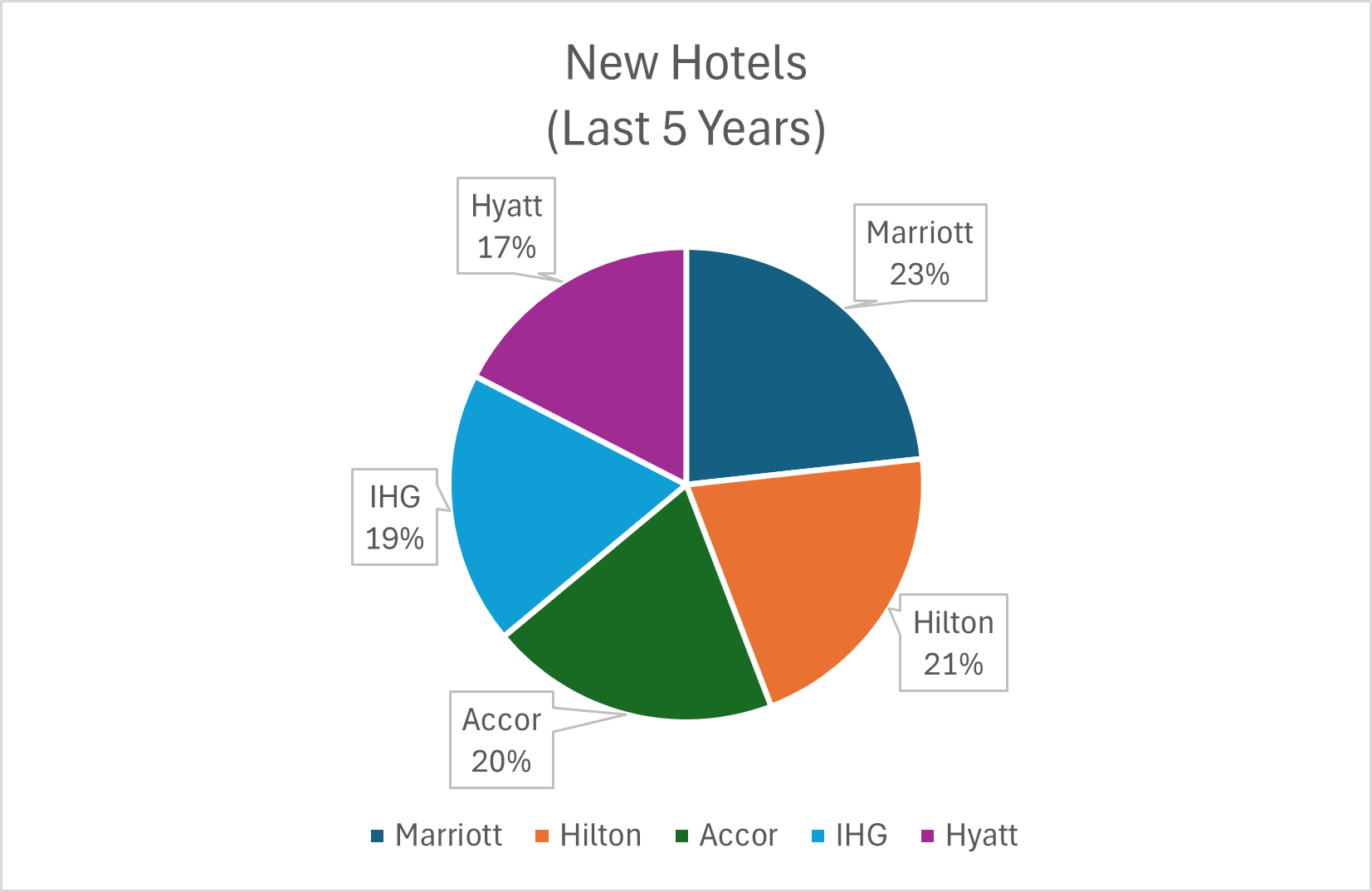

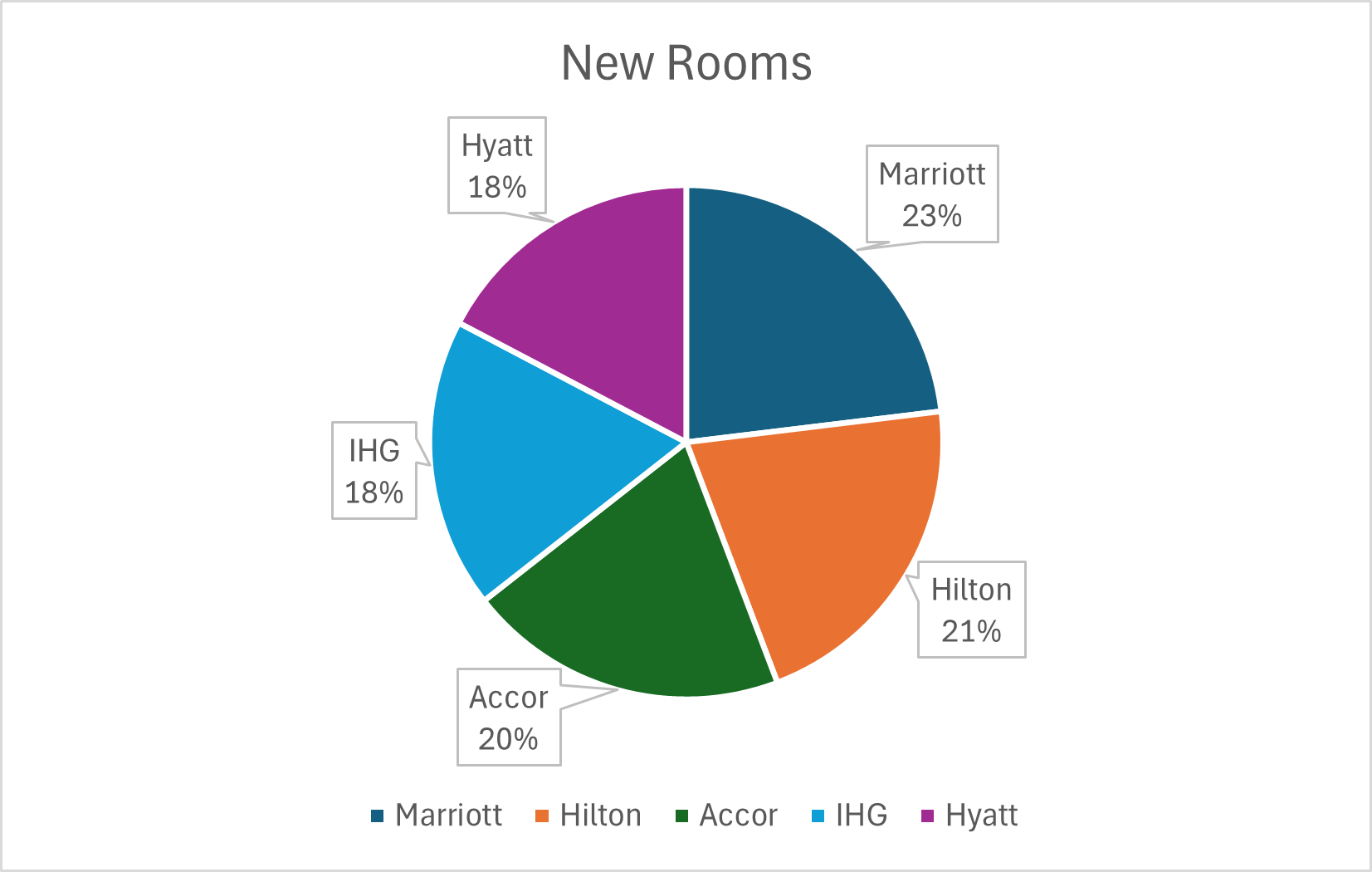

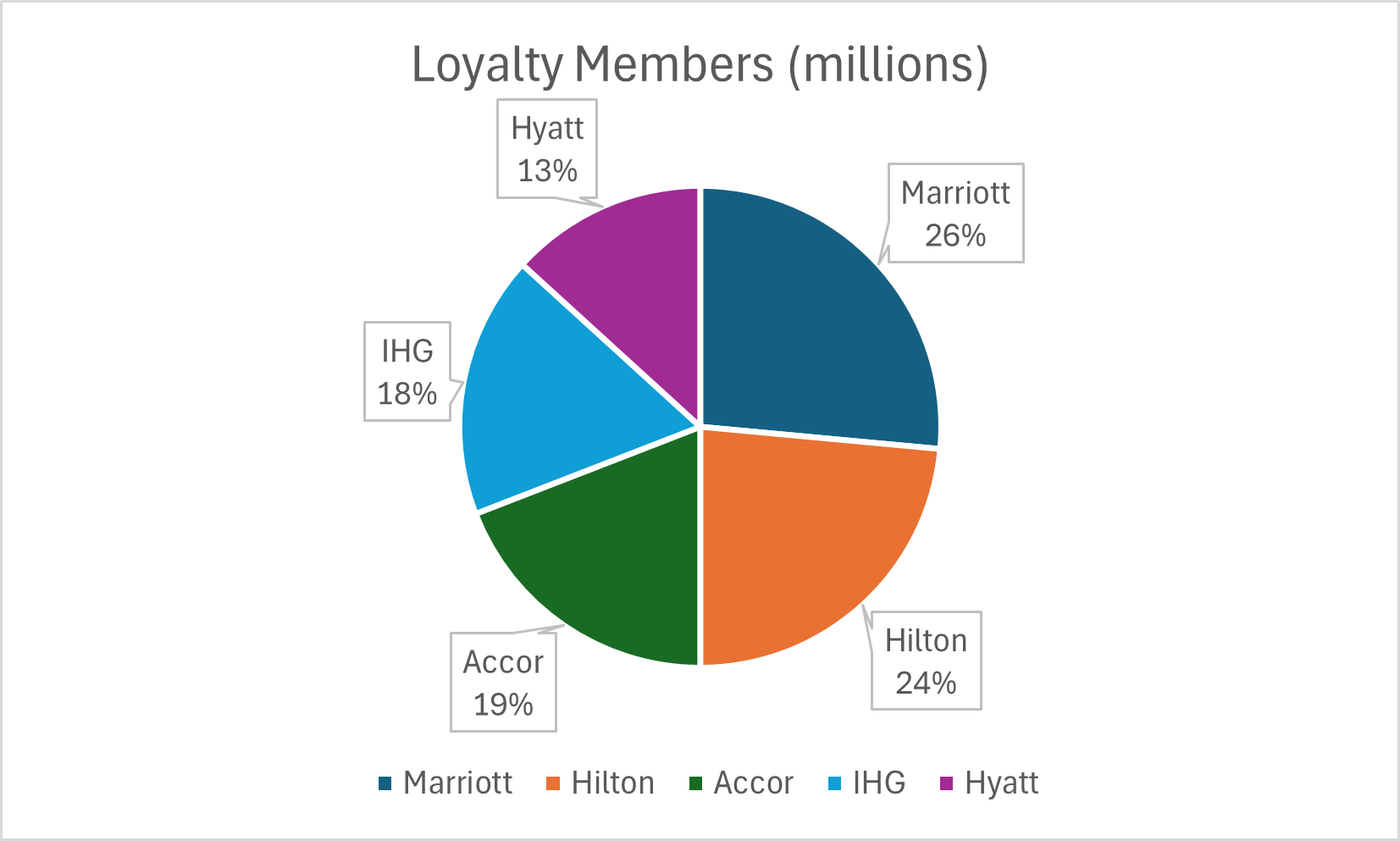

Brand | New Hotels | New Rooms | Resort Expansion | Major Acquisitions | Loyalty Members (millions) |

Marriott | 100 | 12000 | 30 | 2 | 180 |

Hilton | 90 | 11000 | 40 | 1 | 160 |

Accor | 85 | 10500 | 25 | 3 | 130 |

IHG | 80 | 9500 | 35 | 4 | 120 |

Hyatt | 75 | 9000 | 50 | 3 | 90 |

Despite differing approaches, these leading hotel brands share several common factors that have powered their successful expansion in Europe:

Strategic Mergers & Partnerships: All five leveraged consolidation to grow. Marriott’s Starwood merger (just before our five-year window) set the stage, and others followed with targeted deals – Accor absorbed Fairmont/Raffles, IHG partnered with Iberostar and acquired Six Senses/Regent, Hyatt bought ALG, and Hilton allied with brands like SLH. These moves gave instant access to new properties and customer bases.

Brand Portfolio Diversification: Each company offers a wide range of luxury brands to capture different niches. From ultra-luxury (Accor’s Raffles and Orient Express; Marriott’s St. Regis) to lifestyle boutique (Hyatt’s Andaz/Thompson; IHG’s Kimpton) to soft brands for conversions (Marriott’s Luxury Collection; Hilton’s LXR/Curio; Accor’s MGallery/Emblems; IHG’s Vignette), this diversification allows growth in various segments. Notably, soft brands and collections have fueled many conversions of independent hotels, a key expansion method.

Focus on Leisure Destinations: A major trend driving expansion is the boom in high-end leisure travel. All five groups heavily invested in resort markets – especially in the Mediterranean, Caribbean, and Middle East – anticipating sustained demand for luxury vacations. Hilton doubled its resorts in EMEA, Marriott and IHG launched all-inclusive brands, and Hyatt and Accor acquired resort specialists. This pivot meets travelers’ post-pandemic preference for experiential, resort-based stays (e.g. coastal Spain, Greek isles, Riviera) and diversifies revenue beyond traditional city hotels.

Adaptive Reuse and Iconic Properties: These brands have been renovating and rebranding iconic European properties to establish prestige quickly. By pouring capital and design into grande dame hotels (like Carlton Cannes by IHG, or Marriott’s conversion of Madrid’s historic Bellas Artes building into an Edition), they rejuvenate heritage assets under modern luxury brands. This not only preserves cultural landmarks but also offers a fast-track to enter historic city centers where new builds are limited. The success of such projects (often done with local partners and architects) has encouraged further adaptive reuse developments across Europe.

Powerful Loyalty & Distribution Networks: A unifying strength is the ability of these global brands to drive business via loyalty programs and sales systems. Marriott Bonvoy, Hilton Honors, Accor Live Limitless, IHG One Rewards, and World of Hyatt each count millions of members worldwide. Owners increasingly seek out these affiliations, knowing that brand fans from the US, Middle East, and Asia will fill European hotels. For instance, Marriott cited strong interest from independent hotel owners to join for the Marriott Bonvoy exposure and reservation engines. Likewise, partnerships like Hilton–SLH or Hyatt–SLH were built to combine distribution networks with unique luxury inventory. In short, loyalty scale has been a crucial factor making these five companies the partners of choice for hotel developers, enabling faster expansion.

In addition, robust financial performance of luxury travel has underpinned all brands’ growth. Luxury hotels in Europe have led the recovery with higher rates and resilient demand, attracting investment capital. All five groups reported record development pipelines and optimistic owner interest in 2023–2024. By aligning their strategies with industry tailwinds – such as “revenge travel,” the rise of wealthy middle-class tourists, and the appeal of authentic local experiences – these brands have positioned themselves to continue thriving.

Conclusion

Over the past five years, Marriott, Hilton, Accor, IHG, and Hyatt have set the pace in Europe’s luxury hotel expansion. Through a combination of new hotel launches, savvy acquisitions, strategic partnerships, and imaginative rebranding, they have increased their European presence and market share. Each has invested in key destinations (from London and Rome to Ibiza and Mykonos), while evolving their business models to be asset-light and experience-driven. The common success factors – a diversified brand portfolio, focus on leisure/resort markets, adaptive reuse of iconic properties, and strong loyalty ecosystems – have enabled these companies to capture growth and weather challenges. As a result, Europe’s luxury hospitality landscape is more dynamic and consolidated, with these top brands primed to continue their momentum. The trend is clear: scale, coupled with agility in offering unique luxury experiences, has been the recipe for success in the new era of European hotel growth.

Sources:

Nandi, Kathakali. “Hotel brands accelerate growth across Europe.” HOTELS Magazine, Apr. 17, 2024

Chen, Stephanie. “Marriott International Reports Continued Global Growth.” Hospitality Design, Jan. 29, 2025

“Hilton Accelerates Resort Growth Across Europe.” Hilton Newsroom, Apr. 11, 2024

“Hilton Closes Out 2024 with Record Levels of Growth…” Hilton Newsroom, Jan. 27, 2025

O’Neill, Sean. “Accor Bets on Luxury to Close Gap with Marriott and Hilton.” Skift, Jan. 2, 2025

“IHG’s Growing Footprint in Spain.” Travel and Tour World, Oct. 9, 2023

“IHG Expands… with Ruby Deal.” Travel and Tour World, Feb. 18, 2025

“Hyatt to Enter 13 New Markets in EAME.” Danny the Deal Guru, Jan. 23, 2025

Press Release: Carlton Cannes to become Europe’s first new generation Regent Hotel. IHG plc News, Dec. 2022